springfield mo city sales tax rate

Missouri Department of Revenue 2020. Review the sales tax benchmarks.

Missouri Retirement Tax Friendliness Smartasset

Contribution to a City-County jail.

. The Springfield Missouri sales tax is 760 consisting of 423 Missouri state sales tax and 338 Springfield local sales taxesThe local sales tax consists of a 125 county sales tax and. The average cumulative sales tax rate in Springfield Missouri is 866 with a range that spans from 81 to 106. Enter your street address and city or zip code to view the sales and use tax rate information for your address.

The base sales tax rate is 81. Create an Account - Increase your productivity customize your experience and engage in information you care about. 3 rows 15 lower than the maximum sales tax in MO.

The tax continues to be 27 cents for 100 of assessed value. This includes the rates on the state county city and special levels. Statewide salesuse tax rates for the period beginning May 2022.

Springfields sales tax is 81 which includes the following breakdown. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax. Our voters then approved a renewal of this income tax rate for 10 more years on the May 2021.

What is the sales tax rate in the City of Springfield. The projects have been completed as promised and with no increase in the tax rate. Springfield MO 65802 Ph.

Rates include state county and. 4 rows Springfield MO Sales Tax Rate The current total local sales tax rate in Springfield MO. The City of Springfield income tax rate increased from 2 to 24 effective July 1 2017.

The Springfield City Code Chapter 70 Article V requires hotels motels and tourist courts to pay a tax equal to 5 of the gross rental receipts paid by transient guests for sleeping. The minimum combined 2022 sales tax rate for Springfield Missouri is. 042022 - 062022 - PDF.

The current total local sales tax rate in Springfield MO is 8100. 17 rows City Sales Tax City County and State taxes Knoxville TN. The 81 sales tax rate in Springfield.

This includes state sales tax of 4225 the city sales tax of 2125 and the county sales tax rate of 175. This is the total of state county and city sales tax rates. The latest sales tax rates for cities in Missouri MO state.

The taxes are collected and administered by the state the county or the City of Springfield Office of Budget. Find Sales and Use Tax Rates. 14- cent Capital Improvement Sales Tax 2013-2016.

Department of Commerces Economic Development Administration EDA to conduct planning efforts for the. The City of Springfield will receive an 800000 grant from the US. What is the sales tax rate in Springfield Missouri.

View sales tax rates in other Missouri cities. Indicates required field. Statewide salesuse tax rates for the period beginning April 2022.

Missouri Car Sales Tax Calculator

Louisiana Sales Tax Rates By City County 2022

Downtown Springfield To Get New 50 Million Apartment Complex

Sales Taxes In The United States Wikipedia

/cloudfront-us-east-1.images.arcpublishing.com/gray/6LS33VXALREDDEYVTEGCCFGU54.jpg)

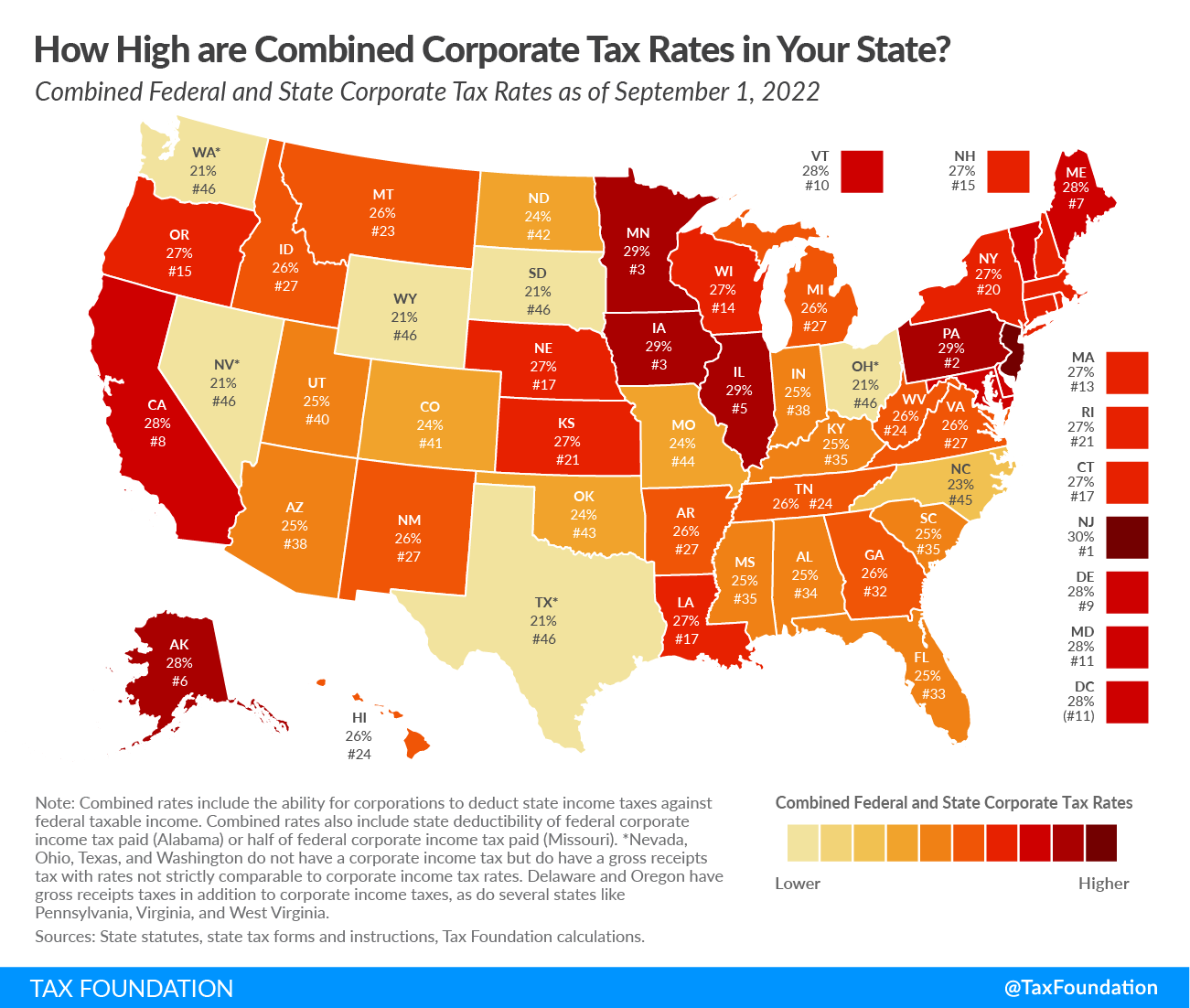

Explainer Tax Cut Trend Reaches Missouri Many Other States

Taxes Springfield Regional Economic Partnership

Sales Taxes In The United States Wikipedia

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Missouri Tax Rates Rankings Missouri State Taxes Tax Foundation

Springfield Mo Businesses For Sale Bizbuysell

City Misses Projections For Sales Taxes Springfield Business Journal

Springfield Missouri S Hot Real Estate Market

The Ultimate Guide To Missouri Real Estate Taxes

Downtown Springfield Community Improvement District

Springfield Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Sales Tax Benchmarks Springfield Mo Official Website